sales tax on leased cars in ny

Find Your 2021 Nissan Now. This means you only pay tax on the part of the car you lease not the entire value of the car.

Car Sales Tax In New York And Calculator Getjerry Com

The most common method is to tax monthly lease payments at the local sales tax rate.

. Calculating the taxes on your lease is easy. Nows The Time To Save Big On Nissans Award Winning Lineup. General use tax rules for such.

In some states however the sales tax is just added to the lease payment on a. Not all states have an agreement with New York. If you made monthly sales tax payments in another state complete form Statement of Transaction Sales Tax Form.

New York collects a 4 state sales tax rate on the purchase of all vehicles. Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. How to apply sales tax to lease or rental transactions.

Sales and use taxes are. In the state of New York they will be subject to an additional special tax on any passenger car rentals. For instance if your lease amounts to 500 a month for three years and youre required to pay 7 percent sales tax on the vehicles value youll end up paying an extra 1260 in taxes over the.

As with any other sales tax you simply multiply your state tax rate by the. See Tax Bulletin How to Register for New York State Sales Tax TB-ST-360. Ad Build Price Locate A Dealer In Your Area.

In addition there is an accelerated sales tax payment provision which will apply to any. Services are subject to tax. Choose from our wide.

Unlike most states for long-term motor vehicle leases New York requires that sales tax. See DFT-804 page 2. Now Signature Auto Group is expanding our services across the New York City area providing fantastic lease deals for Brooklyn and NYC Drivers.

Instead of paying all of the sales. Upon initially leasing the vehicle in New York this individual paid sales tax for the entire lease term. There are also a county or.

For vehicles that are being rented or leased see see taxation of leases and rentals. Publication 839 710 5 Introduction This publication explains the rules for computing State and local sales and use taxes on long-term motor vehicle leases. How is sales tax calculated on a car lease in New York.

Person A leases a vehicle from BMW in NYS and NYS sales tax is calculated as the monthly payment NYS sales tax inspection 36 month lease term. In New York State the full sales tax is collected on that 16000 at the beginning of the lease. Upon initially leasing the vehicle.

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Nj Car Sales Tax Everything You Need To Know

A Helpful Tax Write Offs List For 1099 Contract Dance Teachers Special Thanks To Financialgroove Com For Providing Dance Teachers Dance Teacher Tax Write Offs

Sales Tax On Cars And Vehicles In New York

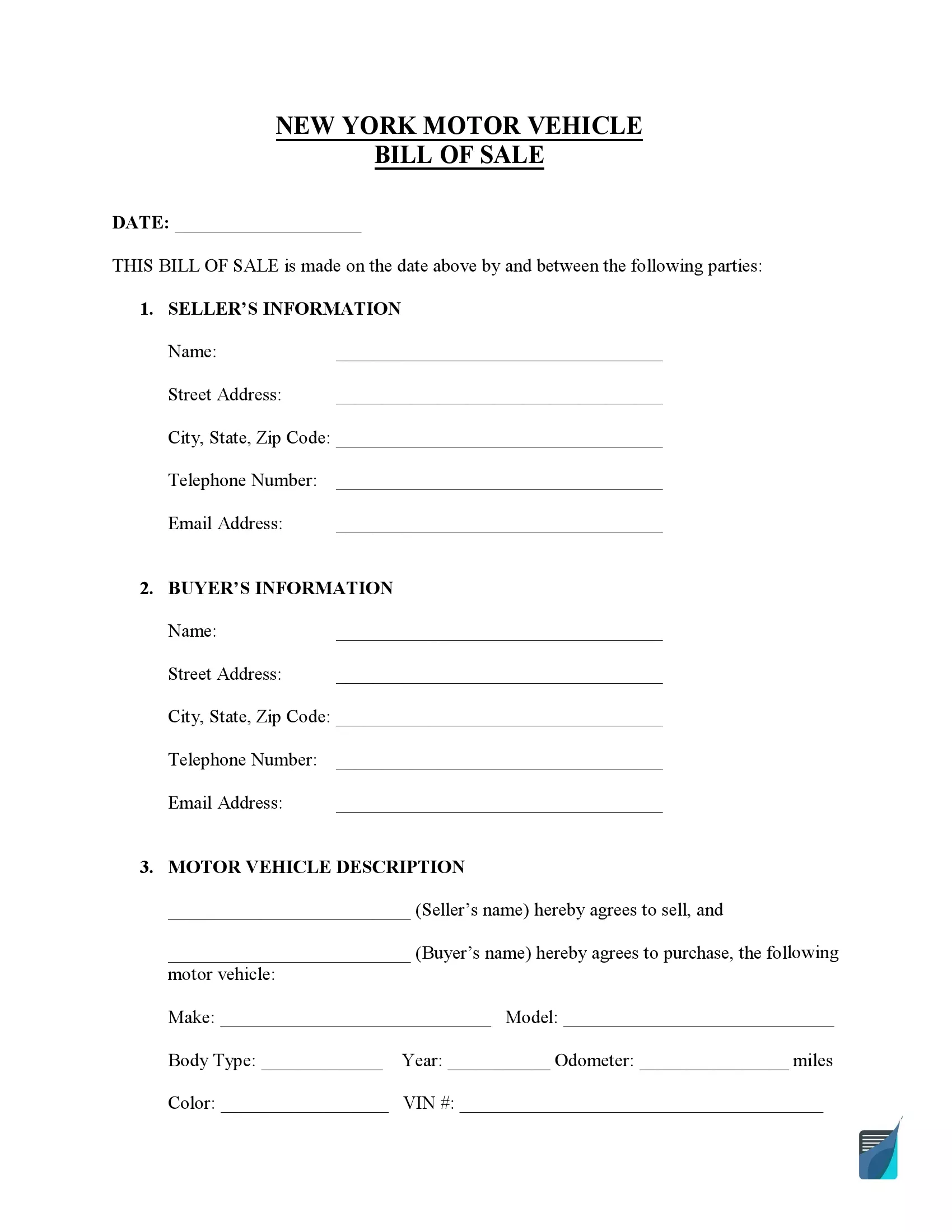

Free New York Vehicle Bill Of Sale Form Pdf Formspal

New York Vehicle Sales Tax Fees Calculator

2013 Cruze Honda Civic Honda Mực

New Toyota Lease Specials Deals Near Me Syracuse Ny Romano Toyota

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

New York Vehicle Sales Tax Fees Calculator

Virginia Sales Tax On Cars Everything You Need To Know

How Much Does It Cost To Register A Car In Ny

What S The Car Sales Tax In Each State Find The Best Car Price

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

New York Vehicle Sales Tax Fees Calculator

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

How New York Drivers Can Save Up To 9 5k When Buying An Electric Car Silive Com